The General Valuation roll for the financial years 2023/24 – 2027/28 has been published by the Overstrand Municipality, and property owners have until 3 April 2023 to object. The Valuation Roll is the official record of the value of all rateable properties within the jurisdiction of a municipality area.

The last general valuation was effective from July 2016 and it was found that property values increased significantly since then to bring it in line with present market values.

Property owners may have been shocked at these significant increases and are rightly so, concerned about how this will affect their municipal accounts. Calculations, based on the new valuations, will be the basis for the new rate in the rand to be recommended to Council for consideration.

This rate or tariff will be tabled to Council on 29 March 2023. The public will be able to consider and comment on the draft budget during April 2023, so please watch out for the notifications and attend and contribute at the public meetings to be held on the budget.

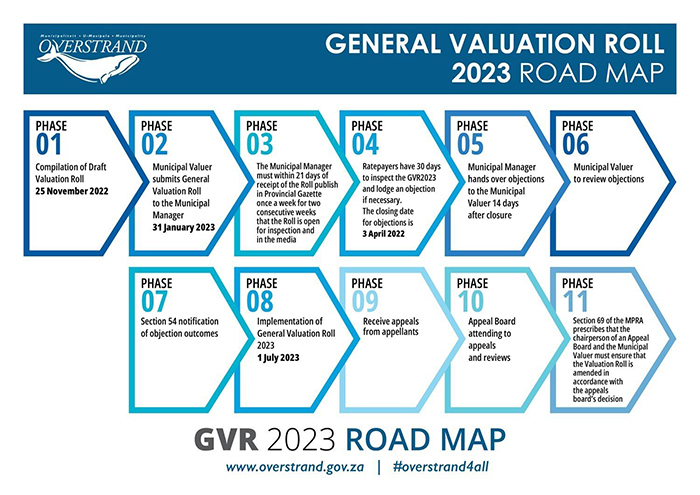

The new valuation roll will be implemented on 1 July 2023 with the valuation roll dated 2 July 2022. (The new roll was handed over as per the date set out in the Local Government: Municipal Property Rates Act, (MPRA), on 31 January 2023).

Understanding property valuations:

Properties are allocated to homogeneous areas, for example Voëlklip properties will be allocated in different homogeneous areas, ie; sea front properties together and properties situated directly on Main Road together etc.

Each town and suburb will be placed into their specific homogeneous areas. It should be noted that property sales history in, for example, Sandbaai, cannot be used to compile valuations in Gansbaai. Therefore, sales on date of valuation up to 2 July 2022 per homogenous area, has then formed the basis for the valuations per area.

The property valuers were also given access to the building plans and the municipal property records which contains all relevant information to enable them to complete the valuations. This was further supported by aerial and kerbside photography; hence the valuation exercise was also supported by making use of available technology.

The valuation roll indicates the market value of the specific property on date of valuation, therefore showing what the owner will most probably sell for on that date or alternatively what somebody will most probably pay for the property.

Current rebates in place:

The following rebates/exemption is applicable for the current financial year. As mentioned earlier recommendations for the new financial period are still to be considered by Council and the public in general as part of the budgeting process.

Residential Property

- Minus: First R15 000 of property value

- Minus: R35 000

- Minus: additional 20% of the levy calculated on such property

Business Property

- No rebates or exemptions

Residential Property outside the municipal service area

- 50% of the tax applicable on Residential property in Urban areas

Business Property outside the municipal service area

- 50% of the tax applicable on Business property in Urban areas

Farms/Agriculture (Bona-fide)

- Agricultural purpose in relation to the use of a property, excludes the use of the property for the purpose of ecotourism or for the trading In or hunting game.

- Residential tariff: R0.00657

Example: Residential property value =

R3 000 000.00 @ R0.00657 = R19 697.40

minus R15 000 @ R0.00657 not taxable = R98.49

minus R35 000 @ R0.00657 discount = R229.80

SUB-TOTAL = R19 369.11

minus 20% discount = R 3 873.82

Tax payable = R15 495.29 per year - Farms / Agricultural: (R0.00657 X 25%) = R0.0016415 (rounded to R0.00164)

Example: Farms / Agricultural =

R3 000 000.00 @ R0.00164 = R4 924.35 per year

Conservation land

- Not rateable in terms of section 17(1)(e) of the Municipal Property Rates Act

Pensioners Rebate

- 100% to approved applicant who are older than 60, who’s gross monthly household income may not exceed the amount of two times (2X) of state funded social pensions per month.

- 50% to approved applicant who are older than 60, who’s gross monthly household income may not exceed the amount of four times (4X) of state funded social pensions per month.

- 40% to approved applicant who are older than 60, who’s gross monthly household income more than four times (4X) but less than eight times (8X) of state funded pension per month.

Undeveloped erven

- No rebates or exemptions

Objecting your property valuation:

An objection must be in relation to a specific individual property and not against the supplementary valuation roll as such. The view is held that property owner who are of the opinion that the new valuation of their property does not reflect the market value, should lodge an objection before the closing date of 03 April 2023. This allows for an opportunity to state your case and to receive reasons on the determination of the valuation from the valuers.

The form for the lodging of an objection is obtainable from the public libraries or any of the Municipal offices at the following addresses:

- Hangklip-Kleinmond (33 Main Rd, Kleinmond) 028 271 8400

- Hermanus (1 Magnolia Street, Hermanus) 028 313 8000

- Stanford (15 Queen Victoria Street, Stanford) 028 341 8500

- Gansbaai (Main Road, Gansbaai) 028 384 8300

- or on the municipal website: www.overstrand.gov.za click on documents, strategic documents, property-valuation.

The completed objection form must be returned to the municipal offices or via email to enquiries@overstrand.gov.za on or before 3 April 2023. Property owners who require assistance in completing the objection forms are welcome to visit the municipal offices where an official will help.

For enquiries, please contact Johette Basson at 028 313 8000/8133 or via email: enquiries@overstrand.gov.za